Google Trends and Search Patterns Predict Stock Market Moves

The relationship between the internet social media and the stock market has reach a crescendo recently with a hacked twitter message causing a stock market crash and authorities becoming concerned a how quickly the stocks move with online trading.

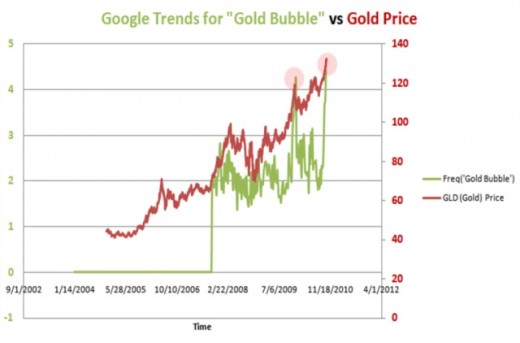

On the flip side researchers recently looked at whether Google search frequency patterns, for certain keywords such as ‘oil', ‘gold', ‘copper', ‘debt' or a certain stock, on a Sunday may herald changes in the stocks, either buy and sell the following week.

The Google ‘Trends' tool is very useful for this purpose because it highlights the search frequency trends for a selected keyword or phrases.

The research highlighted the potential of monitoring keyword use frequency trends for predicting changes in the stock market. This offers a very useful tool for investors.

Does Google Trends Reflect Changes in Investor Sentiment and Likely Responses?

Researchers at a business school in England analysed data using Google Trends for the seven years from 2004 to 2011. They examined almost 100 terms in two groups:

- Finance related: "gold", “unemployment", "metals", "stock", "finance", and "health"

- Control words unrelated to finance: "ring", “family”, “fun”, "train", kitchen"

They examined whether patterns in Google Trends correlated with movements in the stock market.

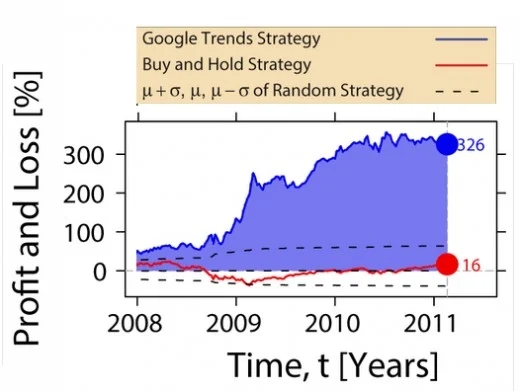

They then set up a virtual portfolio of investments for stocks in the Dow Jones Industrial Average and examined whether the relationships they discovered could be used as an investment strategy. They adopted a very simple set of rules based on examining the search volume trends that occurred on Sundays. The simple concept was that investors who were thinking of selling certain stocks, or were concerned about their positions, they would do some research on the internet about those stocks on the weekend when the market was closed to prepare for the market opening on the next day. If there was little research about the stocks or words that indicated a change in sentiment, this was taken as a sign that the investors were happy and were unlikely to trade the stocks.

- If the search volume was higher on the Sunday than during the previous week, the relevant stocks were sold at the closing price for the previous week, and then bought back again in the following week.

- If the search volumes on the Sunday were lower than during the previous week, the researchers "bought" stocks the following day.

Results from the Study

The best performing word during the study was "debt". The strategy described above showed a yield of more than 300% over the seven years of the study. This was much higher than for other simple strategies. (see the images above).

In the journal publication, the researchers argue that the internet search frequencies for particular words and for general mood in the market terms such as ‘debt’, was an indicator of investment sentiments and subsequent decisions.

When a large number of people start looking for information about a particular topic on a Sunday, this signifies that they are worried about what has happened the week before and are likely to sell some of their stocks when the market opens on the Monday. They looked at other indicators and found a general trend for the market to drop when investors get concerned and lose confidence. When investors are concerned they are likely to search for the information about the situation to help them decide what to do.

The internet is a goldmine about investor sentiments and a lot of other information about what the general public and certain interest groups are researching in the internet using Google and other communication tools such as Twitter and Facebook.

Previous research has established a strong relationship between search frequency and interest patterns.

For example the number of influenza cases was mirrored by the number of search requests for information about influenza. Research has previously shown that Google Trends data accurately reflects the current values of particular economic indicators.

This includes unemployment claims, car sales, travel destination popularity and consumer confidence.

An interesting aspect of the study was the suggestion that these types of analyses could be used to PREDICT what would happen. Most stock market indicators essential follow market trends and the ability to predict stock market moves in the holy grail of investment that has remain illusionary.

The statistical analysis used in the study confirmed the two hypotheses tested:

- Increases in the price of the Dow Jones Industrial Average were preceded by a fall in the volumes of searches for particular related financial terms.

- Decreases in the price of the Dow Jones Industrial Average were preceded by a rise in search volume for particular terms.

This was also confirmed by the success of the trading strategy.

There are a wide range of applications available for using Google Trends Data that have yet to be developed.